Bitcoin Is Not a Store-of-Value.

Before we begin, I’m not just some crypto FUDster. I’ve been in crypto for a long time. My first crypto purchases took place on an exchange called btc-e back in 2014 which later went up the river for laundering funds from the Mt Gox hack. I was a little altcoin degen before most people had even heard the word ‘blockchain’.

We’re talking a college kid’s $300 portfolio split across stuff like Litecoin, Peercoin, Feathercoin, Namecoin, Blackcoin most of which went to zero or was was lost when btc-e went down.

Fast forward to now and I’ve become heavily involved in the crypto space, running a crypto charting SaaS business and formerly heading research at a crypto research company called Token Metrics.

So no, I do not hate crypto and I do not hate Bitcoin. I believe crypto is the future. But after taking a deep dive on token models, I have changed my opinion and don’t think that Bitcoin, in its current state, is a good store of value.

I’ll simply present my case, and you can choose to accept or reject it. No hard feelings if you disagree. I am a proponent of researching and thinking for yourself rather than recycling talking points from YouTube and Twitter.

“BTC is an open system that leaks value, disguised as a closed system that preserves value.”

Any token system can be thought of as a pot of money. Every cryptocurrency is its own pot of money. When people sell, they are taking money out of the pot. When people buy, they are putting money into the pot.

Here’s what most people think the Bitcoin system looks like:

People think, incorrectly, that because there are only 21 million Bitcoin that can ever exist, that the system is closed, and no leaks exist. In this system, if supply outweighs demand, price will go up. Simple. But here’s what the BTC token system actually looks like:

In this more accurate representation, we have miners pulling money out of the pot in two ways: transaction fees, and the selling of their Bitcoin mining rewards. The latter is harmful to BTC’s value in two ways. It dilutes the circulating supply of BTC which decreases its value, and it pulls money from the pot to cover energy costs. A majority portion of the money miners are pulling from the system is being burned forever in the form of energy costs, meaning it has no way of ever re-entering the system.

This is the cost of securing the network with a proof-of-work consensus model.

As of now, the market cap of BTC is $568B.

How much energy does it cost to secure this $568B Bitcoin network?

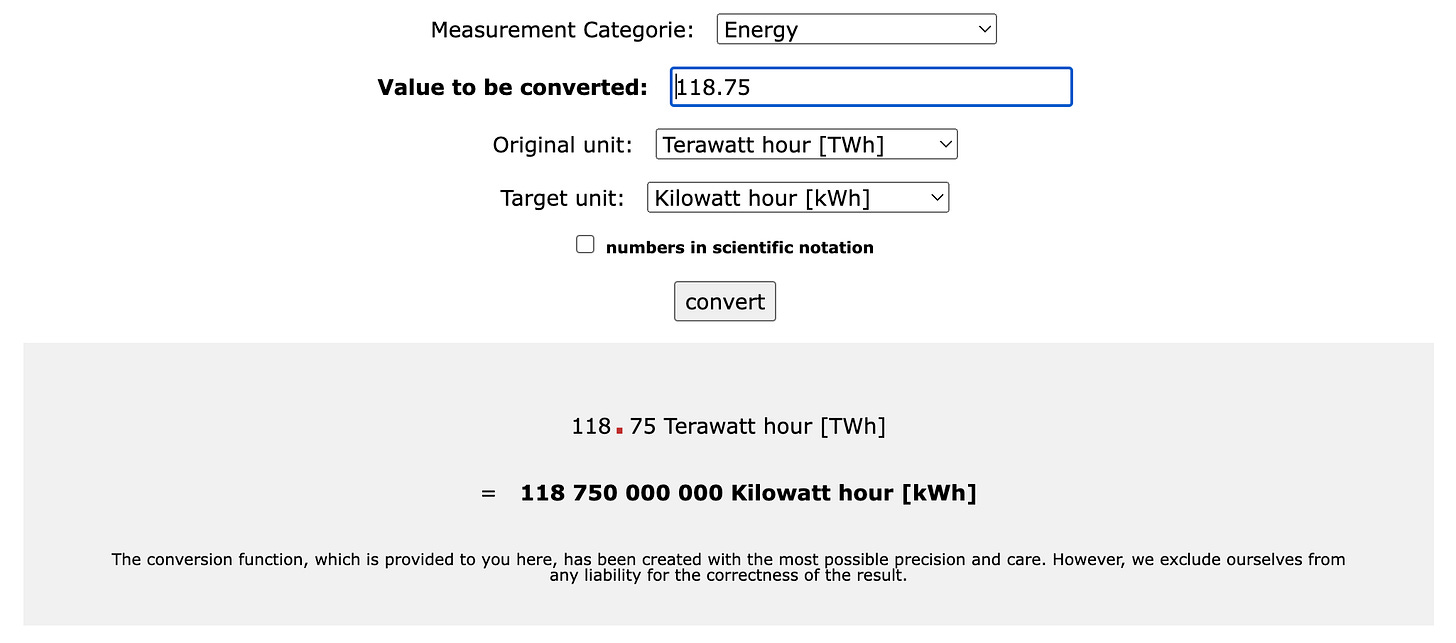

According to the University of Cambridge, about 118.75 tWh (terrawatt hours).

Earlier in the year, this estimate was as high as 150 tWh, but let’s go with the current 118.75 estimate.

Converted to kWh, this is 118.75 billion kWh per year.

The average cost of energy per kWh in the US, the largest Bitcoin mining country in the world (with over 35% of the hashrate located in the US), is 11.78 cents per kWh for businesses and 13.83 cents for residential (source).

Sidenote: the economies of scale (cheaper energy for businesses than residential) when it comes to BTC mining causes hashrate to centralize over time, but let’s not get distracted here.

Okay so 11.78 cents per kWH. But let’s be really conservative since other countries may have cheaper power. We’ll use the lowest number possible, 6.13 cents, which is the industrial average as of March 2022 for the cheapest region in the US (Alabama, Kentucky, Mississippi, Tennessee) according to this source.

6.13 cents x 118,750,000,000 kWh = $7.125B

Let’s run a scenario matrix for the total annual cost to secure the Bitcoin network:

This scenario model is still conservative as we capped it at 200 tWh, which is more than 10% below Cambridge’s upper bound estimate.

If the network is valued at $568B, but costs $7.125B/year or more to secure, that’s a pretty big leak for something that is supposed to preserve value.

Now some of you are already thinking, hey 7.125/568 is only 1.25% per year. But that’s not exactly how market cap works. This 1.25% system leak doesn’t necessarily translate to a 1.25% price decrease per year.

The current $568B market cap valuation assumes that every BTC is worth ~$30k, but we know that every Bitcoin currently circulating could not be sold for $30k as there is not enough liquidity for that to happen without the price dropping. There’s not actually $568B that can be taken out of the Bitcoin pot. In actuality, it’s much less that can be taken out.

So our numerator is $7.125B, but our denominator is actually much lower than $568B, which means the leak is likely much larger than 1.25%. How large? That’s pretty difficult to say.

Bitcoin bulls love to talk about the liquid supply of Bitcoin shrinking due to more holders, but a lack of liquidity is just as detrimental to the downside in terms of price impact as it is beneficial to the upside.

According to Glassnode, (as of April 2022) ~63% of BTC’s supply had not moved in over a year.

So it looks like our denominator is actually closer to 0.37 * $568B = $210B

7.125 / 210 = 3.4%

Interesting.

So not only does this energy leak in the BTC system have a negative impact on price, it’s actually the cost of diluting the circulating supply.

Here’s a comparison that might help us wrap our minds around this. Michael Saylor is said to own 129,218 BTC, valued at ~ $3,876,540,000 ($3.9B) assuming a $30k BTC price. That’s roughly half of our $7.125B leak estimate.

So now imagine two Michael Saylor whales are just dumping ~700 BTC on the market every day or around 250,000 BTC/year. That’s essentially the energy cost of running the Bitcoin network. Who pays for that cost? Not the miners. They are profitable. They pass it onto the Bitcoin holders. Bitcoin holders pay for it in the decreased value of Bitcoin caused by this energy expense.

Another way we can back-check our estimates here is knowing that currently ~900 BTC can be mined per day (144 blocks per day * 6.25 BTC per block). Our prior math roughly checks out that miners may sell an average of ~700 BTC per day to cover costs and keep the other 200 BTC as profit.

900 BTC per day * 365 days * $30k BTC price = ~$9.85B

So our estimated energy cost to secure the network is $7.125B and the estimated yearly revenue for mining BTC at a $30k valuation is $9.85B. Miners do have other costs, like equipment, but let’s ignore everything but energy costs for now for simplicity.

For anyone wondering, based on these estimations our BTC equilibrium price (break even point for miners) would be roughly $22k.

900 BTC per day * 365 days * $22k BTC price = ~$7.125B

But what about the BTC halvings!? The Bitcoin halvings do nothing in terms of reducing or patching the $7.125B leak. Post halving, it will still cost roughly the same amount of energy to secure the network given the same hashrate.

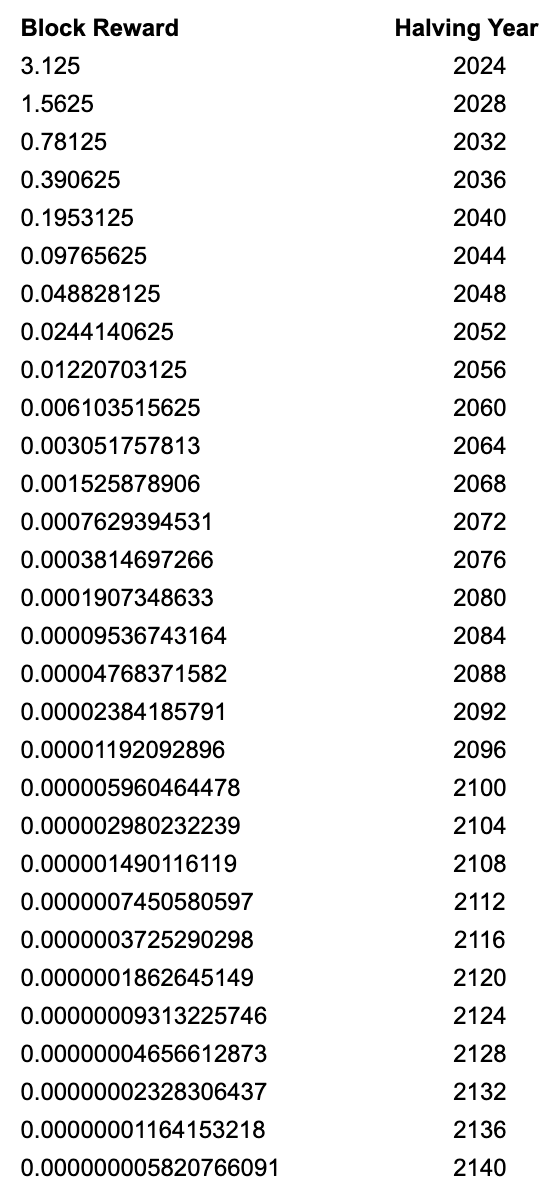

Halvings simply reduce the mined supply of Bitcoin by 50%, hence the name ‘halving’.

So instead of 900 BTC mined per day, it will be ~450 BTC after March of 2024.

So if it costs $7.125B worth of energy per year to secure the network at the current hashrate, BTC would have to go to ~$44k for miners to break even on energy alone. Remember, there is still a yearly cost of $7.125B to secure the network. And it would be a minimum of $88k in the next halving (2028).

Let’s go through this again, but a little slower.

Right now, at the current hashrate, miners break even on energy expenses at a BTC price of $22k. Post 2024 halving, that break even point, at the current hashrate, goes up to $44k. If BTC does not go to $44k, miners will be unprofitable and hashrate will have to drop (miners going out of business) to reduce the cost of securing the network, also reducing the security.

If you know anything about the power of 2, you already know that things get very big, very fast. If we’re 3 halvings into 32 total halvings, then the estimated break even point for miners at current hashrate going into the last halving would be:

$22,000 * (2^27) = $2,952,790,016,000 per BTC

$2,952,790,016,000 per BTC * 21 Million total Bitcoin =

$62,008,590,336,000,000,000 BTC Market Cap

The block rewards shrink so fast that after enough halvings bitcoin would eventually require a $2.95 trillion price per Bitcoin and a $62 quintillion market cap to sustain the current cost of $7.15B/year.

Even if these numbers were somehow realistic, can you imagine securing a $62 quintillion market cap on only $7.15B/year of hashrate? Lol.

And that’s assuming energy costs do not increase at all over the next 120 years, which they will.

So basically BTC mining will eventually become so unprofitable the hashrate (network security) will shrivel up UNLESS it is subsidized by BTC transaction fees.

But who is actually transacting on the Bitcoin network? No one. And I doubt anyone ever really will. When it comes to all transaction metrics, Bitcoin is horribly unscalable and expensive to transact on.

The Bitcoin network is doing around 250k transactions per day (source).

250,000 * 365 = 91,250,000 transaction per year

$7.125B / 91,250,000 tx = $78 per transaction.

It’s currently costing $78 in energy overhead to secure a single Bitcoin transaction.

Bitcoin was originally designed to be peer-to-peer cash, then when everyone realized it doesn’t scale, the store-of-value narrative emerged.

But we just proved the store-of-value narrative breaks down because of the $7.125B/year leak and the fact that mining is unsustainable long-term unless it is subsidized by transaction fees, which will not exist because transacting on Bitcoin is slow and expensive. It’s a vicious cycle.

What about the lightning network? I can do a separate write-up on the the lightning network, but it would simply be a more poorly written version of this article:

Mathematical Proof That the Lightning Network Cannot Be a Decentralized Bitcoin Scaling Solution

The summary is that mathematically, the lightning network can only scale with centralized banking hubs like Strike (who can freeze, reverse, and blacklist transactions) which completely defeats the purpose of a decentralized currency.

Yes, Strike is centralized and holds your Bitcoin in custody. Taken directly from their website:

The same Bitcoin maximalists who scream “not your keys, not your crypto” are the same maximalists that are happy to tout the lightning network as Bitcoin’s scaling solution. Make it make sense.

Not to mention, the lightning network takes transactions OFF the layer 1 Bitcoin network, when we JUST proved that Bitcoin mining will eventually need to be subsidized by fees from transactions ON the layer 1 network.

Let’s just fast forward through the next few halving cycles assuming that demand for Bitcoin can manage to outpace the reward halvings so that BTC mining stays profitable. In 2036, when the block reward is 0.390625 BTC per block, $7.125B worth of energy from Bitcoin miners would require a BTC price of $352k. Doesn’t seem too crazy… Until you realize the market cap of Bitcoin would then be ~$7.3 trillion and it would only take a little over $3.5625B (51% attack) in annualized energy costs to gain consensus of a $7.3 trillion network. Doesn’t seem so secure after all. Especially after most of the hashrate has centralized over time to cold geographical areas with the lowest energy costs.

But what if price is much higher than $352k by 2036? I doubt it will be. Why? Because as Bitcoin’s price goes higher, more miners are incentivized to mine BTC, increasing the energy used to mine BTC and thus increasing the entire system’s energy leak to more the $7.125B, putting increased negative pressure on the price of BTC.

The higher BTC’s price goes, the harder the system resists further price appreciation. A store-of-value should not have a built-in mechanism that resists price appreciation. It is not a closed system. It is a leaky system. And a store-of-value should not have leaks.

Let’s summarize:

Bitcoin leaks $7.125B per year to energy costs, which means an additional $7.125B in demand (new money) needs to come in every single year before the price of BTC can even think about going up. This bill is passed from the miners to BTC holders.

The energy cost to secure the network is not sustainable in the long-run as BTC has to at least double in price every 4 years for the current hashrate to remain profitable for miners. It will eventually have to be subsidized by transaction fees, which there will not be enough of to appropriately secure the network.

Is it really that bad?

Putting aside the long-term security issues, in the grand scheme of things, is a $7.125B per year leak really that bad? Can’t we outrun that by increasing demand? If the price of Bitcoin goes down, so will the cost to secure the network, right?

If Bitcoin were the only cryptocurrency, (which it was for a while), it wouldn’t be that bad of system. The leak might be a justifiable tradeoff in return for a decentralized network where centralized entities cannot freeze or block transactions.

But unfortunately for Bitcoin, price is a function of supply AND demand.

In order for Bitcoin’s price to go up, there has to be demand. Period. Demand means new people willing to invest their money into Bitcoin as a ‘store-of-value’. Well guess what happens when competition enters the space and people have more than one option for a decentralized store of value? They will pick the better option.

It’s not that Bitcoin’s leak is all that bad. It’s the fact that there’s a leak at all in the presence of competitors who do not have leaks that makes it bad.

Will investors choose to invest in a system that leaks value, or a system (like Ethereum post-merge) that is designed to accrue value? Obviously, they will pick the one that is designed to accrue value.

Additionally, Bitcoin’s energy requirements cap its maximum potential demand, or addressable market, at a much lower level than non-PoW protocols. You can choose to personally agree or disagree with the stance that many environmentally conscious investors have taken against Bitcoin, but you cannot deny the fact that they exist and have taken a stance.

Their lack of willingness to invest in protocols that burn large amounts of energy undeniably means less money for Bitcoin, and more demand for more energy efficient protocols.

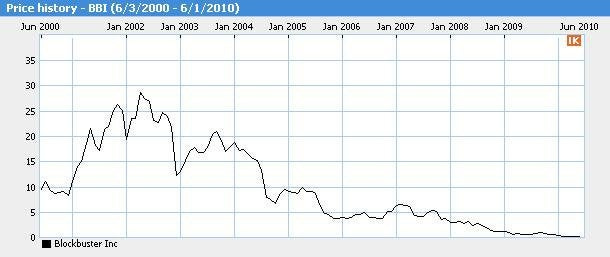

In the 1990s and early 2000s Blockbuster was amazing. My dad would take my brother, sister, and me as kids on a Friday night and we loved it. We’d rent 2 movies and a Nintendo 64 game and be SET for the weekend. Fond memories.

But you know what happened next. Competition from a better, more scalable system with fewer leaks came in. Video streaming. Video streaming was cheaper for end users, far more scalable (no brick and mortar overhead), and a much better experience as you could pick a movie without having to get in the car and drive.

Proof-of-work has serious overhead in the form of energy consumption, which gives a massive competitive advantage to non-proof-of-work consensus mechanisms.

I won’t delve into the nuances of proof-of-work vs proof-of-stake, but while we’re on the topic I’ll address one of the most common (and nonsensical) arguments from the proof-of-work crowd. They believe that proof-of-stake makes the rich get richer, when in fact this is actually the case for proof-of-work

If you want to stake $20M worth of ETH, you can run a validator node, delegate it, or buy a staked ETH derivative like stETH and you’ll get roughly the same apy as everyone else.

Anyone with $20M to invest in Bitcoin mining will get a significantly higher rate of return on their investment than someone with only $15k to invest in BTC mining as they will be able to source cheaper energy in bulk, can afford to relocate to a colder climate with cheaper energy, and will receive bulk discounted pricing on their mining equipment.

If you are reading this article in an email, the post is too long to fit within gmail’s character limits. You can read the rest of the post here.

So what’s the most likely cryptocurrency to steal this demand and market share from BTC? At this point in time its probably Ethereum as they are upgrading the system from proof-of-work to proof-of-stake which will remove their energy expenditure overhead. ETH has plenty of utility outside of ‘store-of-value’, but its value accrual tokenomic system post-merge will actually make ETH a tremendous store-of-value. It’s a closed system with minimal leakage that accrues value:

Ethereum’s system (post-merge) has minimal leakage (the cost to run a validator node is nominal in comparison to a proof-of-work mining operation). Additionally, the Ethereum system is designed to accrue token value by slowly deflating the supply by burning a portion of each transaction fee. This means network usage is a bit more expensive for the end user, but their usage of the network benefits all holders of ETH by burning some of the supply. Additionally, because there is no massive energy cost to staking, network validators do not have to sell the incoming supply of ETH in order cover costs. In fact, because the supply is deflationary, they are incentivized to hold.

The obvious weak point in the Ethereum model is that the network could be cheaper to transact on if the fee burn did not exist, which ultimately reduces the incentive to transact on the network. This trade-off is a negative for many dApps on the Ethereum network that require transactions to use, but a massive positive for ETH as a store-of-value.

Ethereum is far from perfect and I am far from an Ethereum maximalist. I’m simply comparing token models to demonstrate the fact that Bitcoin will face competition in coming years from stronger token models with no leakage and token value accrual mechanisms.

Why would an investor choose to store value in a token system that leaks value when they could choose one that doesn’t leak value, has higher demand potential due to being more eco-friendly, and has a deflationary supply that leads to value accrual in the token (number go up tokenomics)?

At the very least, you have to admit that BTC would be far better off if it could maintain the same level of security without the energy cost, yet many BTC maxis try to spin it as a feature, saying that the energy expenditure is what backs Bitcoin. What? Yes, that’s right. Some people actually believe that Bitcoin is “thermodynamically backed”.

This is utter nonsense. There's no such thing. BTC is backed by demand just like everything else in the world. Remove the demand and price falls.

Would you like to know how else I know Bitcoin is not thermodynamically backed? If you could remove the high energy consumption without sacrificing security or decentralization, it would be a net positive for Bitcoin.

High energy consumption is not a positive feature. It's a negative by-product of Bitcoin’s proof-of-work consensus mechanism.

Bitcoin, as a decentralized protocol, does have the ability to fork and move to a more energy efficient model, however, past attempts at forking Bitcoin to accomplish even minor improvements have had disappointing results. By the time Bitcoin is forced to fork, I expect that it will be too late and the execution of the fork will damage the value of Bitcoin further by dividing supporters into two camps.

Blockbuster had the cash and the ability to pivot to digital streaming, but did not have the foresight. They actually turned down the opportunity to buy Netflix in 2000 for $50M.

What is Bitcoin actually?

Bitcoin is a powerful brand that has mobilized and united many people under the cause of decentralization against the broken, and unfair legacy financial system.

I agree with this cause. Bitcoin was a phenomenal first attempt, just like Blockbuster was amazing while it lasted. But to think that we nailed it on the first try is crazy. I cannot think of a single piece of technology that hasn’t been improved for the better over time. Would you prefer to use a computer from 1988? A tablet from 2014? A car from 1932? Would you attempt to fly across the Atlantic ocean in the first airplane ever made? Of course not. Technology gets better with time. Period.

To beat a dead horse with another analogy, the USS Constitution, was finished in 1797 and is the oldest ship in the world still floating. It was a badass warship for its time. In the War of 1812, it captured many merchant ships and defeated 5 British warships.

But would you feel comfortable sailing into battle on it now? Of course not. Its propulsion mechanism (sails) is no longer relevant in a world of motors and propellers. It’s built out of wood instead of metal. Its technology is so outdated that it isn’t possible to upgrade it to match current day technology.

If Bitcoin is to succeed, it needs a clear path of upgrade-ability, which I do not believe it currently has. Yes Bitcoin has a strong and powerful brand, but so did Blockbuster…

What’s actually going on with Bitcoin?

Bitcoin was originally designed to be used as peer-to-peer digital cash. It says so on line 1 of the whitepaper:

When early Bitcoin supporters realized Bitcoin was not a feasible digital cash solution due to lack of scalability, they pivoted to the store-of-value narrative. But it’s clear that Bitcoin is not a great store-of-value, nor was it designed to be a store-of-value. For those of us who were around pre-2016, there was no mention of store-of-value. It’s a narrative that was fabricated later on to defend Bitcoin’s short-comings as digital cash and draw in new investors.

Bitcoin, like any investment, benefits from an increase in demand (new investors coming in). Early Bitcoin supporters are incentivized to evangelize Bitcoin to anyone and everyone who will listen.

This message has been repeated so many times that demand for Bitcoin has risen and led to large bull markets which are sparked by reward halvings. Blockchain technology has attracted so much money and attention that it has created an echo-chamber led by larpers and pretend analysts that don’t truly understand token systems. We live in a world where social media lends power to those with large audiences, usually the loudest voices, who are not always well informed. Yet they shout about how great Bitcoin is and shun anyone who raises legitimate questions about Bitcoin, saying things like “have fun staying poor”.

Really? What a great argument…

That’s exactly what Do Kwon said before LUNA and UST collapsed.

Don’t peak under the hood. Don’t ask questions. Just trust and believe.

This is exactly why LUNA was able to become a top 10 cryptocurrency before it death spiraled. The voices of reason get blotted out by the majority believers driven mad by greed and confirmation bias. I’m not saying Bitcoin is going to death spiral like UST and LUNA, just comparing similarities in the communities.

People blindly worship the mysterious Satoshi Nakamoto and perpetuate the idea that he was so genius that he was able to solve everything on the first try. It’s weird and cringey.

Those who do understand Bitcoin’s short-comings as a store-of-value dare not say anything as the rest of the crypto market is heavily correlated to Bitcoin. It’s in the entire crypto market’s short-term interest to see BTC do well. Long-term, however, it is not.

How long can the market continue to larp before the math and tokenomics start to manifest in major losses of demand to competition? 2 years? 4 years? 8? 12? Sure, Bitcoin has a lot of momentum behind it and may continue to appreciate in price in lock-step with its halving cycles for some time to come. Or it may fail to innovate and upgrade and ultimately fall in a similar fashion to Blockbuster.

It’s time to stop larping. Bitcoin is not a good store-of-value.

Summary:

Bitcoin is not a closed system. It leaks value in the form of energy consumption required to secure the network. Currently that leak is estimated to be ~$7B per year.

Bitcoin is not a bad store-of-value because it cannot procure >$7B in new demand to overcome $7B per year in costs.

It’s that this leak exists in a market where competitors do not suffer from the same problem that make Bitcoin egregiously vulnerable to competition. That is what makes Bitcoin a bad store-of-value.

It is the emergence of tokens with stronger utility, that ALSO have stronger store-of-value mechanics combined with Bitcoin’s inability to upgrade that will ultimately be the downfall of Bitcoin.

I love Bitcoin but it does worry me sometimes as to where its heading. Your article is compelling and food for thought. Thank you

Awesome article, thanks for writing this. I think ETH has issues of its own (see for example https://senatus.substack.com/p/why-99-of-cryptocurrencies-centralize) but I think your analysis of Bitcoin's (lack of) future is spot on. Kudos.